The Los Angeles Sales Tax rate is set to increase again on October 1. If you operate a business located in the county, or ship/deliver items to customers located in the area, make sure to update your rates in your POS and/or accounting system prior to start of business October 1.

Tax rates increased in July 2017, so you may be surprised there is another increase so soon. But because voters approved Measure H in March of this year, another 1/4% increase will take effect.

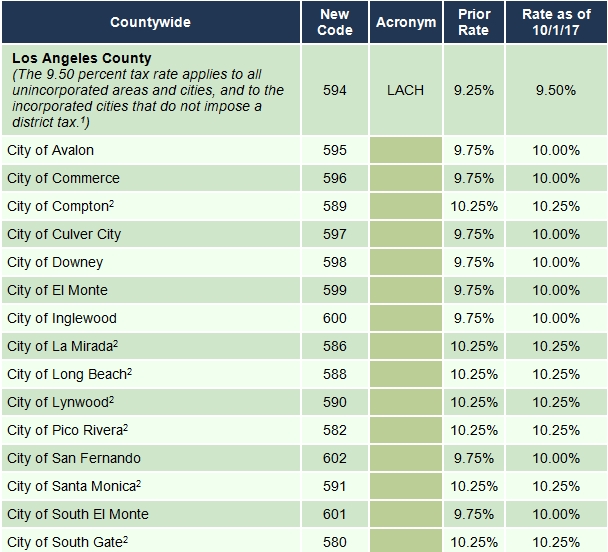

Los Angeles County will be 9.5%, but there are many locations with higher rates due to voter approval on the local level. The rates will be:

- City of Avalon 10%

- City of Commerce 10%

- City of Compton 10.25%

- City of Culver City 10%

- City of Downey 10%

- City of El Monte 10%

- City of Inglewood 10%

- City of La Mirada 10.25%

- City of Long Beach 10.25%

- City of Lynwood 10.25%

- City of Pico Rivera 10.25%

- City of San Fernando 10%

- City of Santa Monica 10.25%

- City of South El Monte 10%

- City of South Gate 10.25%

Remember that tax rates are charged based on where the customer receives the goods/services. So if you are located in an LA County city without a higher rate, but ship or deliver goods to clients in a location with a higher tax rate, you must collect and remit the tax based on their locale.

If you have any questions about this topic, contact us or review information on the California Department of Tax and Fee Administration at http://www.cdtfa.ca.gov/ or look up rates on the BOE website by city or county at https://www.boe.ca.gov/app/rates.aspx