January 1,

If you have employees exempt from overtime, it’s important to make sure their wages are adjusted, if necessary, due to this change. L

It’s also imperative to make sure you have the new labor law poster which reflects this new rate where employees can see it. If an employee’s rate of pay will increase on January 1, they must receive notice from the employer by January 7. However, this notice is not required if the change is reflected on a timely itemized wage statement given no later than January 7.

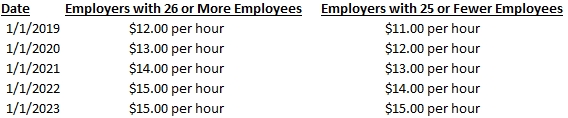

Remember that if you are in the City of Los Angeles or unincorporated cities under county jurisdiction, there is a different pay scale which must be followed as it goes into effect at a faster rate than the state minimum wage.

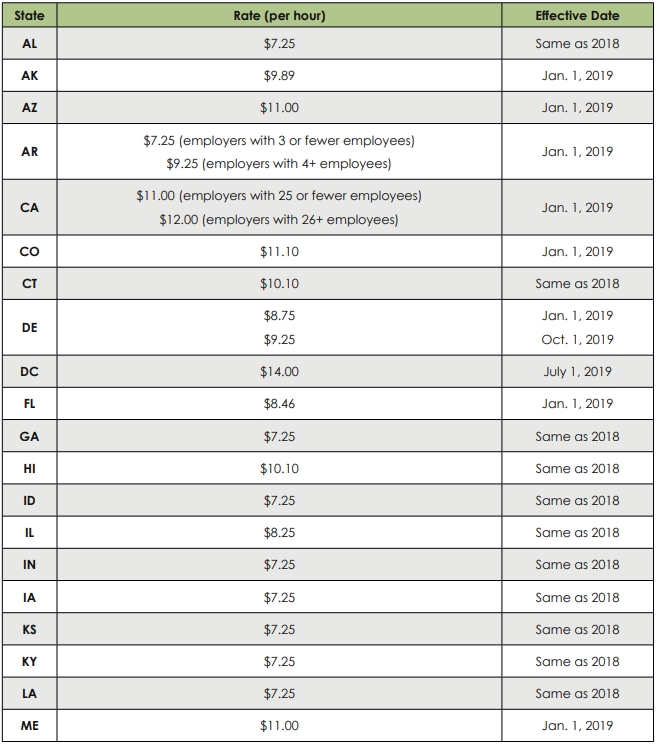

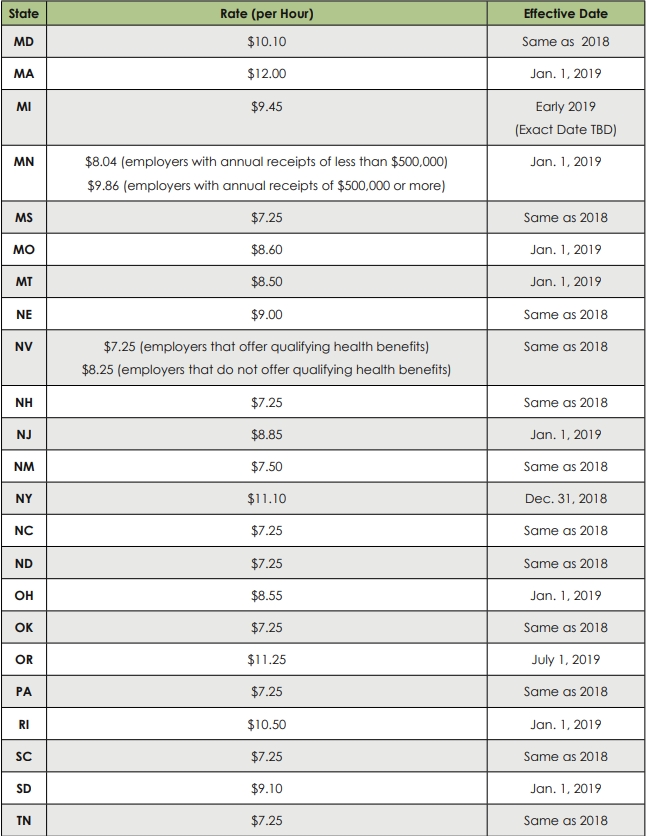

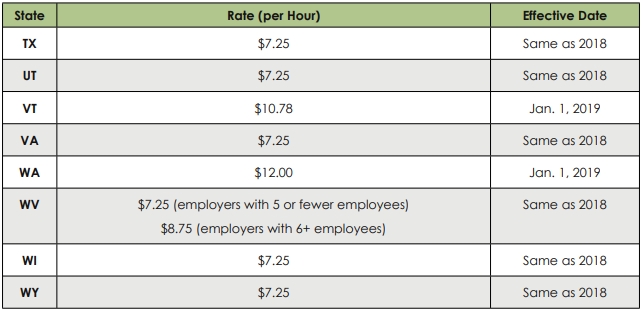

Many wages across the United States are increasing as well. Below is information provided by HR 360 for minimum wage amounts throughout the states.

Remember that the wage amount applies to when the hours were worked, not when paid, so your first paycheck of the year may have earnings from 2018, and therefore can be at the lower rate. If hours worked include those from both 2018 and 2019, you must pay the higher rate for those worked in 2019, or pay all hours at the higher rate.