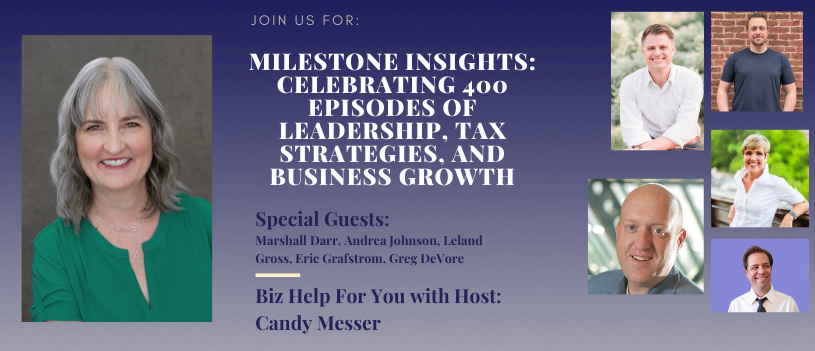

400 episodes and counting! 🎉 From mastering authentic leadership to navigating small business tax strategies and empowering employee confidence—these highlights will transform your business! Don’t miss the invaluable insights from our past 50 episodes! #BusinessGrowth #Leadership #TaxPlanning #EmployeeSuccess #PodcastMilestone

Key Notes

Andrea Johnson: Discusses transitioning from imitating others to defining personal leadership principles for sustainable and magnetic leadership.

Leaving Gross: Shares strategies for small business tax planning, including how to calculate payments to avoid penalties, interest, and stress related to tax compliance.

Marshall Dar: Explains how businesses can offer tax-free medical reimbursements and navigate health benefits compliance, especially when managing teams across multiple locations.

Greg Devor: Talks about the risks of relying on “tribal knowledge,” where critical information is stored in employees’ heads, creating challenges when others need to step in.

Eric Crafton: Highlights the dangers of owner dependency in businesses and what can happen when a key employee leaves or the owner wants to exit without having proper systems in place.

Closing Message: Encourages sharing the episode with others who might benefit from these insights, along with a thank-you for continued support over 400 episodes.

Links

Compliance Corner: Navigating the Small Business Regulatory Landscape, https://youtu.be/UHkxWM_Imc0

Embodying Magnetic Leadership: Elevating Your Impact with Core Values, https://youtu.be/M4_heJj3RL8

Small Business Tax Planning Strategies with Leland Gross, https://youtu.be/X7O3c3_h074

Planning Your Business Exit with Eric Grafstrom, https://youtu.be/lE_FdcTtjWw

Improve Employee Confidence By Relying on Guided Knowledge with Greg DeVore, https://youtu.be/fMcTzoFE1CY

The Clockwork System That Allowed My Business to Run Without Me, https://youtu.be/4I8l_cpApCk