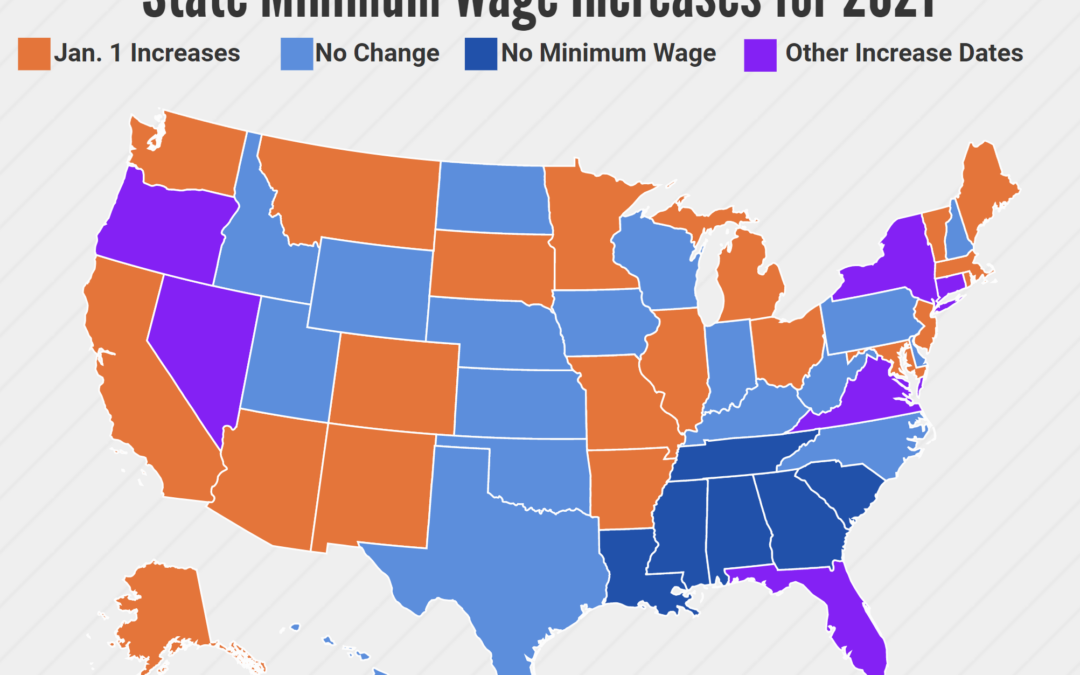

It’s that time of year again to talk about minimum wage increases scheduled to take effect January 1 (December 31, 2020 in the case of New York State). With the pandemic seriously impacting businesses and their struggle to stay open, I’d hoped that there would be stay on increases for 2021. But so far, this is not the case. It’s important to be aware that you must raise wages if you are located in any of the locations with updates.

Currently, there are a significant number of states with changes according to HR Daily Advisor. The following are the changes taking effect:

State Minimum Wage Changes Effective December 31, 2020

New York State: $12.50 per hour. Annual indexing to continue increasing up to $15.00.

- Fast food employees outside of New York City (in fast food establishments): $14.50 per hour. Increasing to $15.00 per hour on 7/1/21.

- Fast food employees in New York City (in fast food establishments): $15.00 per hour.

- Long Island and Westchester Counties: $14.00 per hour. Increasing to $15.00 on 12/31/21 and annual indexing after 2021.

State Minimum Wage Changes Effective January 1, 2021

Alaska: $10.34 per hour. Adjusted annually January 1.

Arizona: $12.15 per hour. Adjusted annually on January 1.

Arkansas: $11.00 per hour. Tipped employees must regularly earn at least $20 per month in tips.

California: $14.00 per hour with 26 employees or more; $13.00 per hour with fewer than 26 employees. Scheduled wage increases (if no increases are paused) for 26 employees or more: $15.00 per hour on 1/1/22, and then adjusted annually. For 25 employees or less: $14.00 per hour on 1/1/22; $15.00 per hour on 1/1/23, and then adjusted annually.

Colorado: $12.32 per hour. Adjusted annually on January 1.

Florida: $8.65 per hour. Increasing to $10.00 on 9/30/21; $11.00 on 9/30/22; $12.00 on 9/30/23; $13.00 on 9/30/24; $14.00 on 9/30/25; and $15.00 on 9/30/26.

Illinois: $11.00 per hour. Increasing to $12.00 per hour on 1/1/22.

Maine: $12.15 per hour. Adjusted annually on January 1.

Maryland: $11.75 for businesses with 15 or more employees and $11.60 for businesses with fewer than 15 employees.

- For businesses with 15 or more employees, the rate will increase to $12.20 on 1/1/22; $13.25 on 1/1/23; $14.00 on 1/1/24; $15.00 on 1/1/25.

- For businesses with fewer than 15 employees, the rate will increase to $12.20 on 1/1/22; $12.80 on 1/1/23; $13.40 on 1/1/24; $14.00 on 1/1/25; $14.60 on 1/1/26; and $15.00 7/1/26.

Massachusetts: $13.50 per hour on 1/1/21. Increasing to $14.25 per hour on 1/1/22 and $15.00 per hour on 1/1/25.

Michigan: $9.87 per hour. Adjusted annually on January 1.

Minnesota: $10.08 per hour for large employers (annual gross revenue $500,000 or more) and $8.21 per hour for small employers (annual gross revenue less than $500,000). Adjusted annually on January 1.

Missouri: $10.30 per hour. Increasing to $11.15 per hour on 1/1/22 and $12.00 per hour on 1/1/23. Adjusted annually on January 1.

Montana: $8.75 per hour. Adjusted annually on January 1.

New Jersey: $12.00 per hour for employers with more than 5 employees; $11.10 per hour for seasonal employers and/or small employers with 5 or fewer workers, and $10.44 per hour for agricultural employers.

- For employers with more than 5 employees, the rate will increase to $13.00 on 1/1/22 and $14.00 on 1/1/23.

- For seasonal and small employers, the rate will increase to $11.90 on 1/1/22; and $12.70 on 1/1/23.

- For agricultural employers, the rate will increase to $10.90 on 1/1/22 and $11.70 on 1/1/23.

- Adjusted annually on January 1.

New Mexico: $10.50 per hour. Increasing to $11.50 per hour on 1/1/22, and $12.00 per hour on 1/1/23.

Ohio: $8.80 per hour for gross receipts of $323,000 or more; $7.25 per hour for gross receipts under $323,000. Adjusted annually on January 1.

Rhode Island: $11.50 per hour.

South Dakota: $9.45 per hour. Adjusted annually on January 1.

Vermont: $11.75 per hour. Adjusted annually on January 1.

Washington: $13.69 per hour. Adjusted annually on January 1 after 1/1/21.

State Minimum Wage Changes Going into Effect After January 1, 2021.

Connecticut: $13.00 per hour, effective 8/1/21. Increasing to $14.00 on 7/1/22; $15.00 on 6/1/23, and then adjusted annually on January 1.

Nevada: $9.75 per hour for employees without healthcare benefits; $8.75 per hour for employees with healthcare benefits. Effective on 7/1/21. Increasing to $10.50 per hour on 7/1/22 for employees without healthcare benefits and $9.50 per hour on 7/1/22 for employees with healthcare benefits.

Oregon: An employer’s location affects the minimum wage rate:

- Within Portland’s urban growth boundary (metro area; including portions of Clackamas, Multnomah, and Washington counties): $14.00 per hour, effective on 7/1/21. Increasing to $14.75 per hour on 7/1/22.

- Areas not in Portland’s urban growth boundary or one of the listed nonurban counties (urban counties; Benton, Clackamas, Clatsop, Columbia, Deschutes, Hood River, Jackson, Josephine, Lane, Lincoln, Linn, Marion, Multnomah, Polk, Tillamook, Wasco, Washington, and Yamhill counties): $12.75 per hour, effective on 7/1/21. Increasing to $13.50 per hour on 7/1/22.

- The nonurban counties (rural counties; Baker, Coos, Crook, Curry, Douglas, Gilliam, Grant, Harney, Jefferson, Klamath, Lake, Malheur, Morrow, Sherman, Umatilla, Union, Wallowa, and Wheeler counties): $12.00 per hour, effective on 7/1/21. Increasing to $12.50 per hour on 7/1/22.

Virginia: $9.50 per hour, effective 5/1/21. Increasing to $11.00 per hour on 1/1/22 and $12.00 per hour on 1/1/23.

Image courtesy of HR Daily Advisor and www.BLR.com