While preparing and filing your taxes might not be the most enjoyable experience, there is one facet of tax season that many businesses look forward to each year: refunds. If you have paid more than your fair share of taxes throughout the year and can prove so through your income forms and documentation for your deductions, then you may receive money back from the IRS after filing your taxes. This extra money can add to your yearly budget or make its way back into your pockets.

But when will you get your tax refund?

According to CPA Practice Advisor, that depends on several factors, including when you file, what credits you are claiming, what method you use to file your return (mail or e-file,) and whether you already have outstanding debts to the government.

The IRS has announced that it opened filing season for individual filers on January 27th, 2020. If you are claiming the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC) processing of your return is likely to be delayed two to three extra weeks.

The deadline to file 2019 tax returns and pay any amount that you owe is Wednesday, April 15th, 2020 unless you have filed Form 4868 for an extension to file. In general, the IRS issues e-filed refund payments within 15 days of accepting a return.

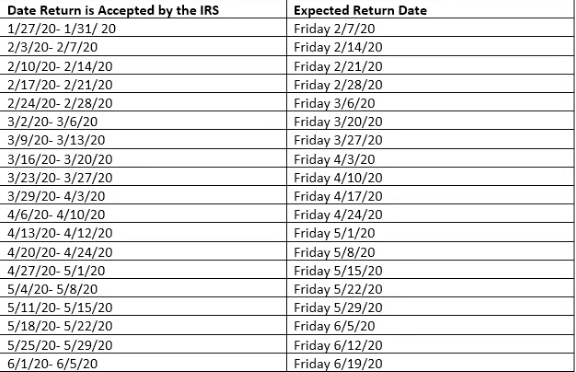

The chart below can help you calculate approximately when you will receive your refund based on when you file.

Estimated Tax Refund Timeline

Keep in mind that if you are claiming one of the credits mentioned above, processing may be delayed to provide time for the IRS to verify the credits. You should calculate your expected refund timeline by the date that IRS notifies you that your return is accepted rather than the date that you file. If you mail your return in, you can expect an additional 3-4 week delay for processing.

Regardless of when you are filing your tax return, you should consult with a tax professional to ensure that all of your deductions are valid and supportable and that you are going to receive your maximum refund.