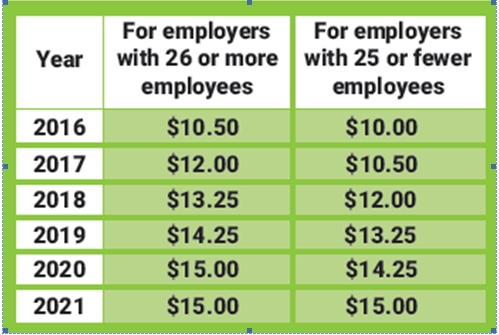

If you are an employer in the city of Los Angeles, or unincorporated areas of LA County, are you aware of the increasing minimum wage? Due to legislation passed that took effect July 1, 2016 raising earnings over 6 years, the minimum wage is set to increase July 1, 2017.

Anyone who works at least two hours in a one-week period within unincorporated areas of Los Angeles County is entitled to the minimum wage for the hours worked. The employee’s employment status, where they live, or where your business is headquartered does not determine the minimum wage that applies.

To find out if work done is in an unincorporated area of L.A. County, enter the address at the County Registrar-Recorder’s website or call DCBA.

These rates are the same for the City of LA and are applicable to non-profit organizations as well. For specifics on who is exempt and disclosure requirements, visit www.dcba.lacounty.gov/wageenforcement or contact (800)593-8222.

Please note, failing to meet all requirements surrounding the implementation of the wage increase can result in fines. We have listed them below for your convenience, with a brief explanation on how they can be applied.

| Violation | Fine Amount |

| Failure to post notice of the Los Angeles Minimum Wage rate and Sick Time Benefits- Municipal Code Section 188.03.A. | Up to $500 |

| Failure to allow access to payroll records – Municipal Code Section 188.03.B. | Up to $500 |

| Failure to maintain payroll records or to retain payroll records for four years – Municipal Code Section 188.03.B. | Up to $500 |

| Failure to allow access for inspection of books and records or to interview employees – Municipal Code Section 188.03.C. | Up to $500 |

| Retaliation for exercising rights under this article – Municipal Code Section 188.04 – The Penalty for retaliation is up to $1,000 per employee. | Up to $1,000 |

| Failure to provide employer’s name, address, and telephone number in writing – Municipal Code Section 188.03.A or 188.05.B. | Up to $500 |

| Failure to cooperate with the Division’s investigation – Municipal Code Section 188.05.B. | Up to $500 |

| Failure to post Notice of Correction to employees – Municipal Code Section 188.06.D. | Up to $500 |

City of Los Angeles Administrative Fines for Violations

Each and every day that a violation exists constitutes a separate and distinct violation. Any administrative fine assessed within a three(3)-year period in any Notice of Correction and determined to be a subsequent violation of the same provision by the same Employer may be increased cumulatively by fifty (50) percent from the maximum administrative fine allowed.

It’s imperative that employees working in these areas are paid the proper minimum wage to avoid penalties. If you have any additional questions, see the information for LA County or the City of Los Angeles.