by Candy | Dec 31, 2020 | Business, Featured, Taxes

If you are an individual, family, or a business owner and struggling to pay your income taxes, the IRS has some payment plans that may help you. The first one is an installment agreement. This would allow you to make a payment plan with the IRS to help you make...

by Candy | Dec 29, 2020 | Business, COVID-19, News

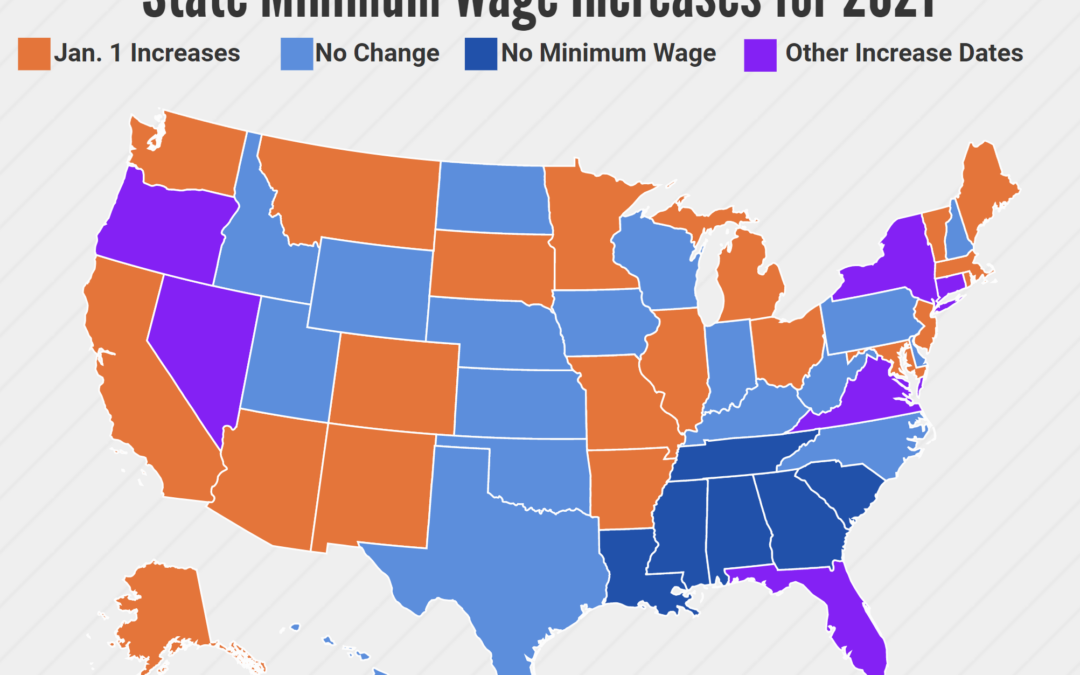

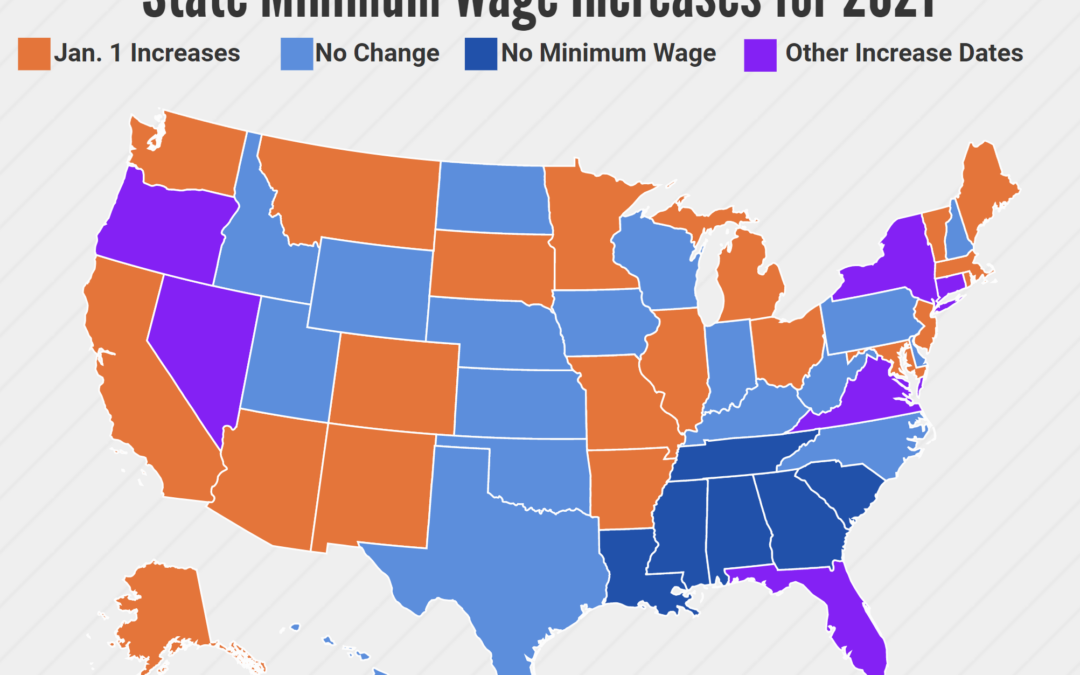

It’s that time of year again to talk about minimum wage increases scheduled to take effect January 1 (December 31, 2020 in the case of New York State). With the pandemic seriously impacting businesses and their struggle to stay open, I’d hoped that there would be stay...

by Candy | Dec 23, 2020 | Business, Featured, News, Taxes

Have you noticed that the cost of insurance has gone up year after year? Are you aware that premiums have increased over 54% since 2009? The IRS has recently issued regulations that may help you with the cost of your insurance. It has now allowed two different...

by Candy | Dec 21, 2020 | Business, Communication, Community, COVID-19

The Coronavirus pandemic and the accompanying rise of telecommuting and social distancing have changed the way we communicate with each other. With fewer in-person gatherings and most people working from home, face-to-face conversations are becoming less and less...

by Candy | Dec 18, 2020 | Business, Featured

With the growth of Internet sales, the use of Big Data has become standard with large companies. The sheer volume of data available can be overwhelming to a small business owner. But here’s the good news: you don’t have to be a math person–or even like...

by Candy | Dec 18, 2020 | Business, Taxes

Are you an employer looking to hire staff in your company? Are you aware that there’s a federal tax credit available to you? If you hire someone from a targeted group, the Work Opportunity Tax Credit is issued by the Internal Revenue Service for hiring someone...