by Candy | Aug 2, 2019 | Featured, Taxes

It’s been a long time coming for mobile workers suffering under the tax nightmare of filing state and federal returns in every state their job requires them to visit throughout the year, but change is finally in the air. Reintroduced in early 2019 by Senate Finance...

by Candy | Jul 26, 2019 | Business, Featured

Have you recently been asked to take out backup withholding from someone’s payment and have no idea what that is? We’ve got you covered – this blog post will give an explanation of what it is and what forms of payments to which it applies. What Is Backup Withholding?...

by Candy | Jul 16, 2019 | Business, Featured

For a lot of employers, there’s no question that paying your employees through direct deposit into their bank accounts, versus a paper check, is a lot easier. Saving money and resources that would go to paper supplies, and time and efficiency through simplifying...

by Candy | Jul 9, 2019 | Featured, Taxes

When it comes to our nation’s armed forces if you or your spouse has served in the military, your sacrifice deserves acknowledgment – one of the ways the IRS says “thank you” is several notable tax breaks for members of the military. Have you served or currently are...

by Candy | Jul 5, 2019 | Featured, Payroll

When it comes to keeping your employees – both new hires and existing staff – on the same page, nothing is better than an employee handbook. Useful for ensuring everyone is aware of company expectations, rules, guidelines, and procedures, an employee handbook is basic...

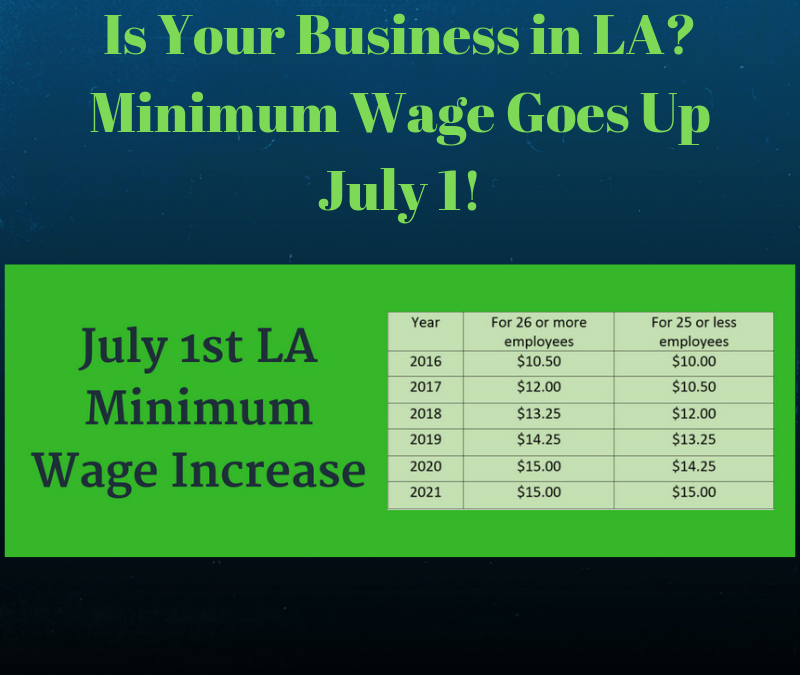

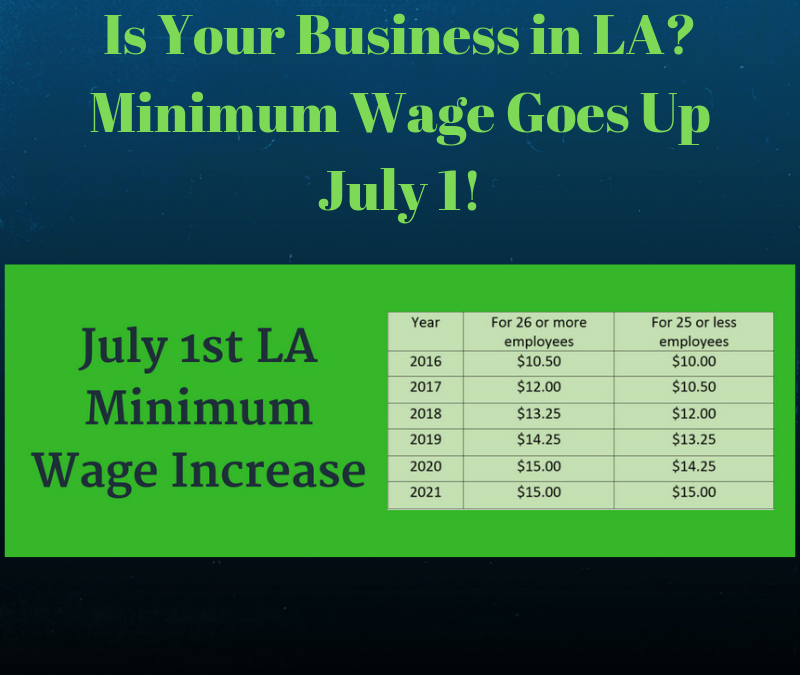

by Candy | Jul 2, 2019 | Featured, Payroll

Is your business operating in the city of Los Angeles or unincorporated areas of Los Angeles County? The minimum wage increased again on July 1, thanks to legislation which took effect on July 1st, 2016. If an employee works at least two hours in Los Angeles county...