by Candy | Sep 28, 2021 | COVID-19, News

In 2021 the American Rescue Plan Act (ARP) was created to help with relief of all types during COVID-19. Since then, the IRS has updated it’s paid sick and family leave tax credits. These updates include the ability for employers to claim tax credits if they...

by Candy | Aug 26, 2021 | Bookkeeping, Business, Community, Featured, News, Shared, Taxes

In the last video, I shared the 2021 Dirty Dozen Tax Scams the IRS specified. Each year, they identify the top 12 methods used for stealing data and other nefarious tactics to get money from unsuspecting victims. Today, I want to share more information to help you...

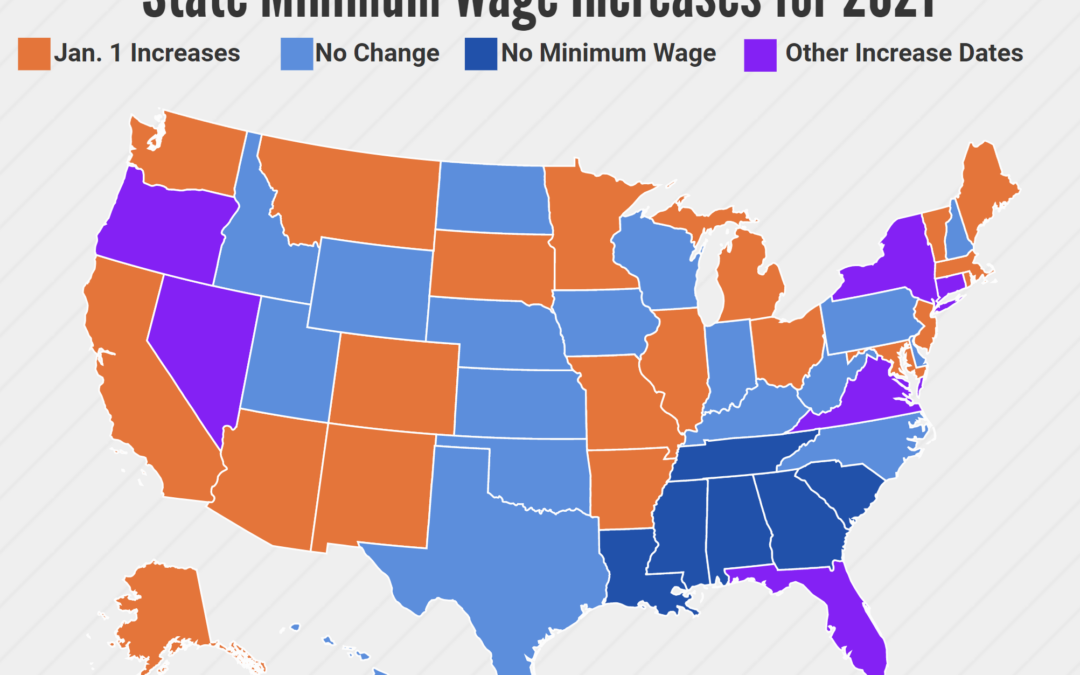

by Candy | Dec 29, 2020 | Business, COVID-19, News

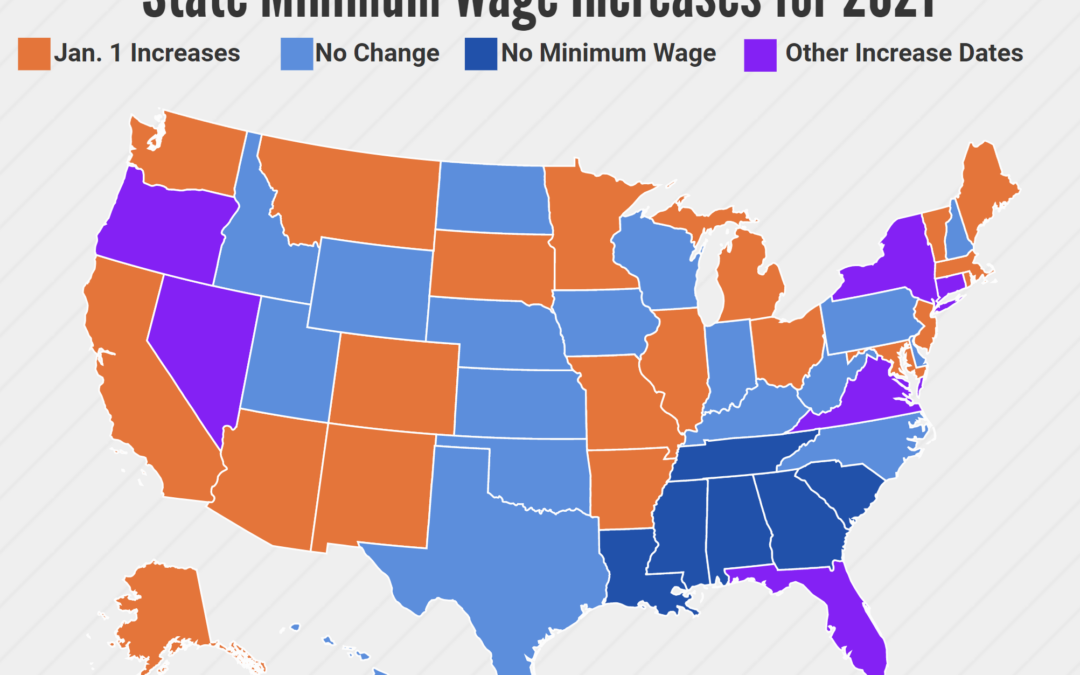

It’s that time of year again to talk about minimum wage increases scheduled to take effect January 1 (December 31, 2020 in the case of New York State). With the pandemic seriously impacting businesses and their struggle to stay open, I’d hoped that there would be stay...

by Candy | Dec 23, 2020 | Business, Featured, News, Taxes

Have you noticed that the cost of insurance has gone up year after year? Are you aware that premiums have increased over 54% since 2009? The IRS has recently issued regulations that may help you with the cost of your insurance. It has now allowed two different...

by Candy | Dec 22, 2020 | COVID-19, News, Taxes

Are you an employer who received a PPP loan and were waiting to find out if the IRS guidelines of non-deductibility were going to remain, or if Congress was going to make an adjustment? Well, I have great news for you! As of Monday, December 21st, Congress passed a...

by Candy | Dec 16, 2020 | Business, Featured, News

According to CPA Practice Advisor, the new flexibility in employee schedules that has come about as a result of the rise of telecommuting during the COVID-19 Pandemic is proving to be a positive trend for productivity. A recent study published by prominent staffing...