by Candy | Apr 27, 2018 | Featured, Sales Tax

A new South Dakota lawsuit against three big-time internet retailers has quickly climbed its way up to the U.S. Supreme Court, earning the possibility of a ruling that could change the law regarding internet sales tax. The lawsuit began when the companies Wayfair...

by Candy | Jan 16, 2018 | Sales Tax

Many small and mid-size businesses hire accountants and bookkeepers with the expectation they’ll help prevent an audit. Unfortunately, it can’t be guaranteed you won’t be audited for sales and use tax. States need sales and use tax revenue to fund essential...

by Candy | Sep 15, 2017 | Featured, Sales Tax

Just ahead of the busy holiday shopping season, states are incentivizing online marketplace sellers to register for tax collection and remittance within their jurisdictions. As ecommerce has risen in recent years, state and local governments are cracking down on...

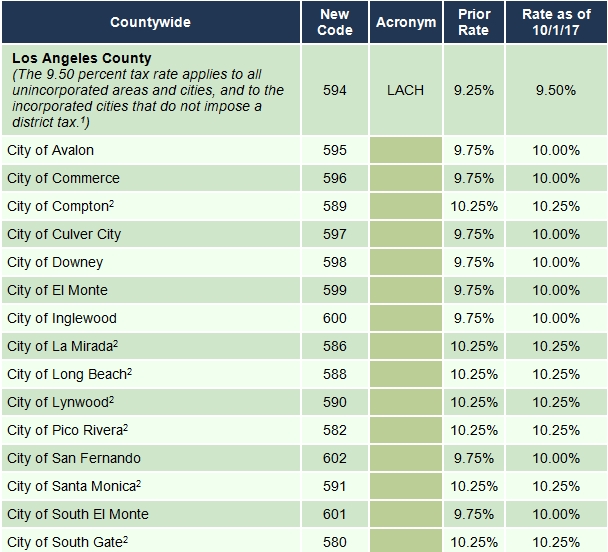

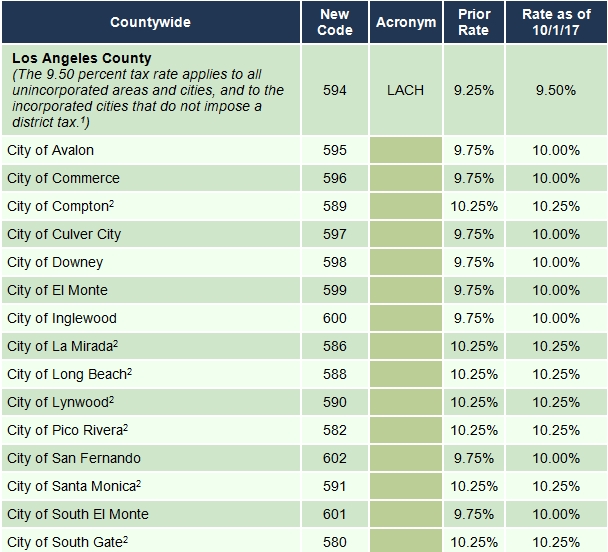

by Candy | Sep 12, 2017 | Sales Tax

The Los Angeles Sales Tax rate is set to increase again on October 1. If you operate a business located in the county, or ship/deliver items to customers located in the area, make sure to update your rates in your POS and/or accounting system prior to start of...

by Candy | Jul 7, 2017 | Sales Tax

In our last blog post, we featured an article discussing the Marketplace Fairness Act (MFA) and how it negatively affects small business owners. You can read that post here: (http://bit.ly/2rI3BFq). This post will focus on the second internet sales tax bill being...

by Candy | Jul 4, 2017 | Sales Tax

For many small businesses that sell online, the reintroduction of the two sales tax bills will affect them greatly. In a post written by Mark Faggiano, the founder of TaxJar summarizes how these two bills reintroduce internet sales tax in way that may make filing tax...