by Candy | Jun 23, 2017 | Featured, Sales Tax

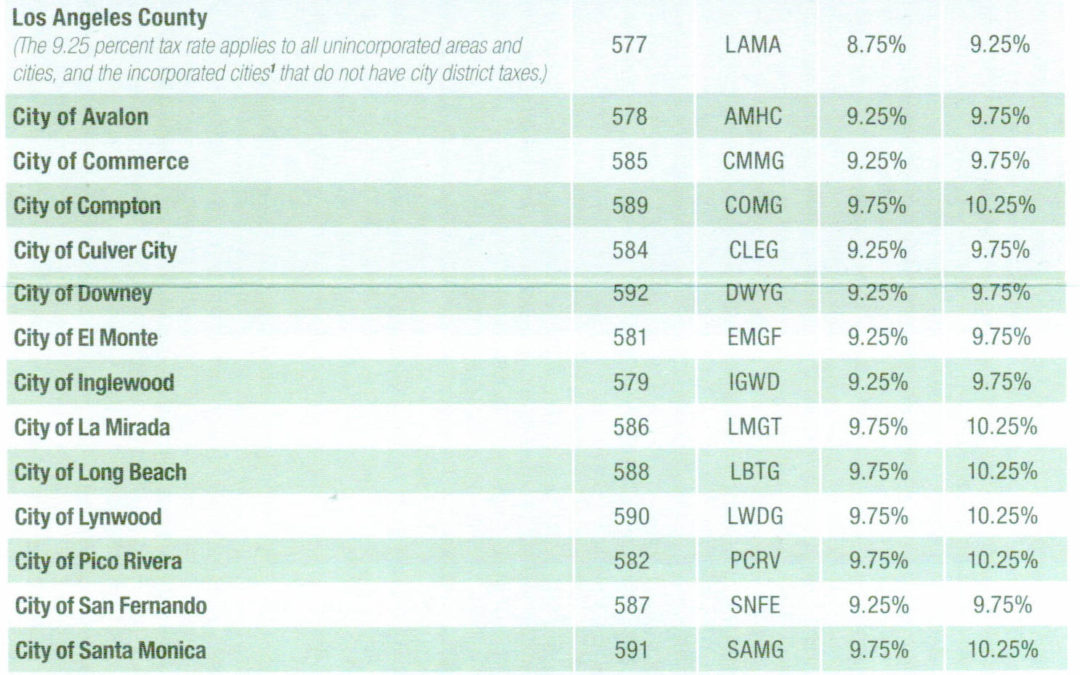

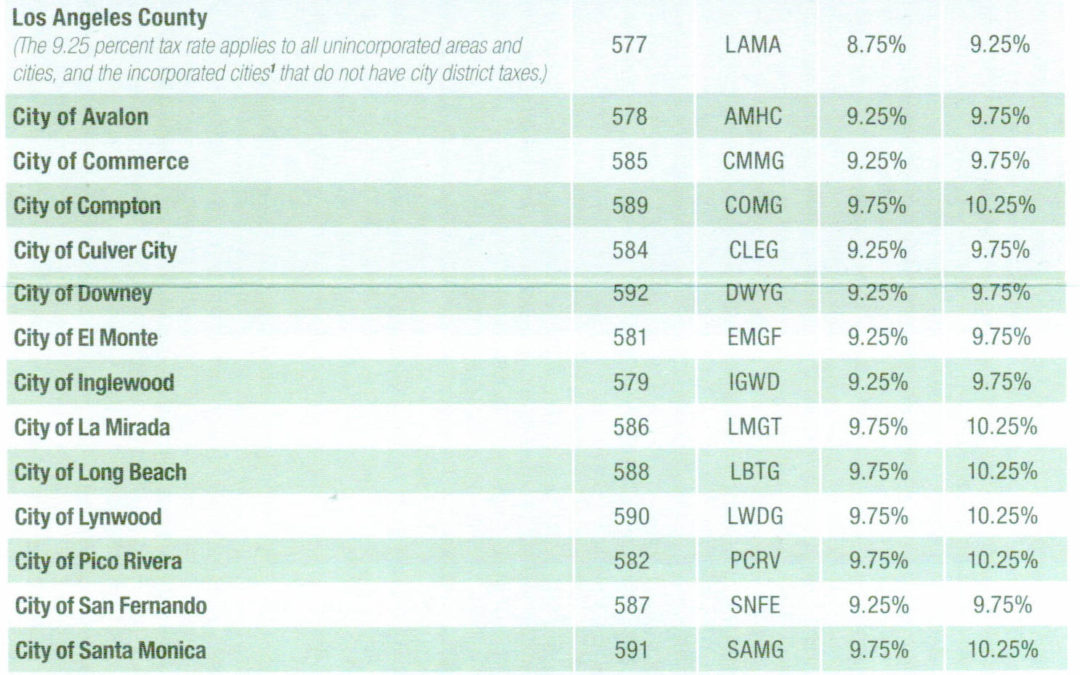

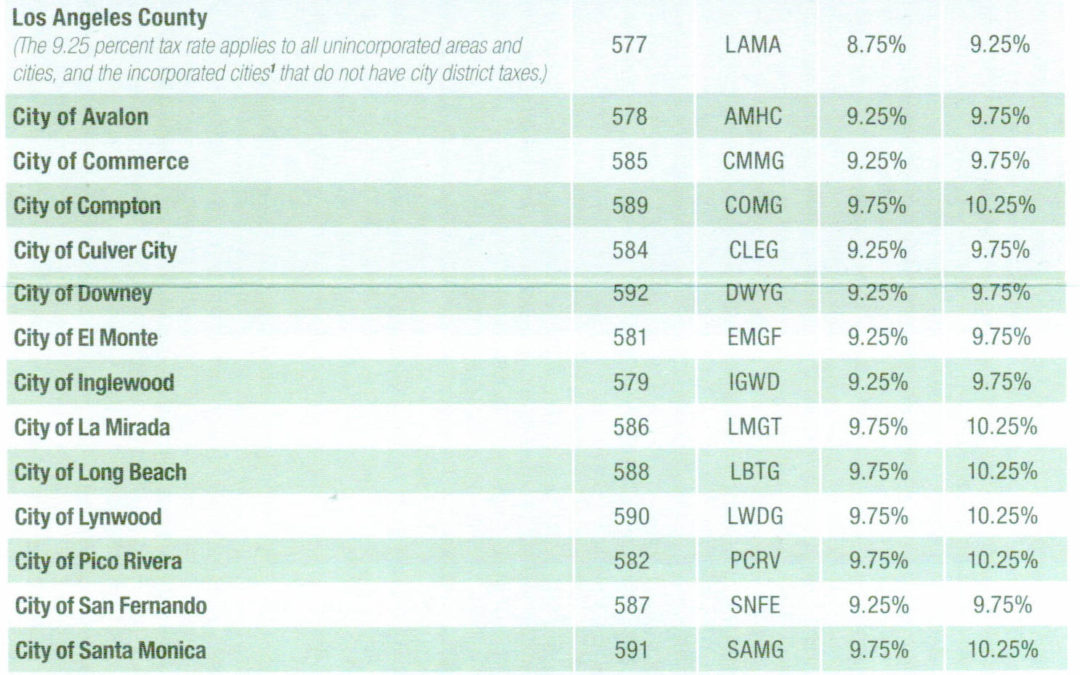

As you may be aware, there is an increase in the LA County sales tax rates taking effect July 1, 2017. In November 2016, voters approved Measure M which applies to Los Angeles County including all cities and unincorporated areas. It is imperative that you know which...

by Candy | Dec 23, 2016 | Featured, Sales Tax

An unusual occurrence is about to take place on January 1, 2017. The state-wide sales tax rate is going to DECREASE. Due to the expiration of an increase passed in 2012, the rate will drop .25% in all jurisdictions from 7.5% to 7.25%. However, the total tax rate in...

by Candy | Oct 21, 2016 | Business, Featured, Sales Tax

I recently read a post on the Avalara website (this company has software that can help with your sales tax compliance) and I thought I’d share their information with you. As states continue to change rules on what is and isn’t taxable, it’s good to...

by Candy | Jul 28, 2015 | Business, Sales Tax

Are you a business selling products to other states? If so, you may be required to collect tax on sales outside of your home state in the not too distant future if you aren’t already required to do so. States are in desperate need of funds, and are looking to...

by Candy | Nov 25, 2014 | Sales Tax

I received information from the State Board of Equalization with information stating that new district boundaries take effect in January. Six counties have been affected by this change. See below for details. The BOE is comprised of four districts each with a...

by Candy | Oct 21, 2014 | Sales Tax

Do you sell taxable products or services? If so, you have tax rates set up in your bookkeeping software, and one (or more) may need to be updated at some point. As you may be aware, tax calculations can often be complicated. You need to know the specific tax rate...