As you may be aware, there is an increase in the LA County sales tax rates taking effect July 1, 2017. In November 2016, voters approved Measure M which applies to Los Angeles County including all cities and unincorporated areas. It is imperative that you know which tax rate applies if you sell to those outside of your business location.

At this time, the BOE is not increasing the sales tax for the passage of Measure H (Sales tax for Homeless Services and Prevention) which was approved in March 2017. Increases usually don’t take effect less than 6 months after the vote is approved, so it could potentially be implemented as early as the 4th quarter of 2017. We’ll have to watch for information to know when this increase will take effect.

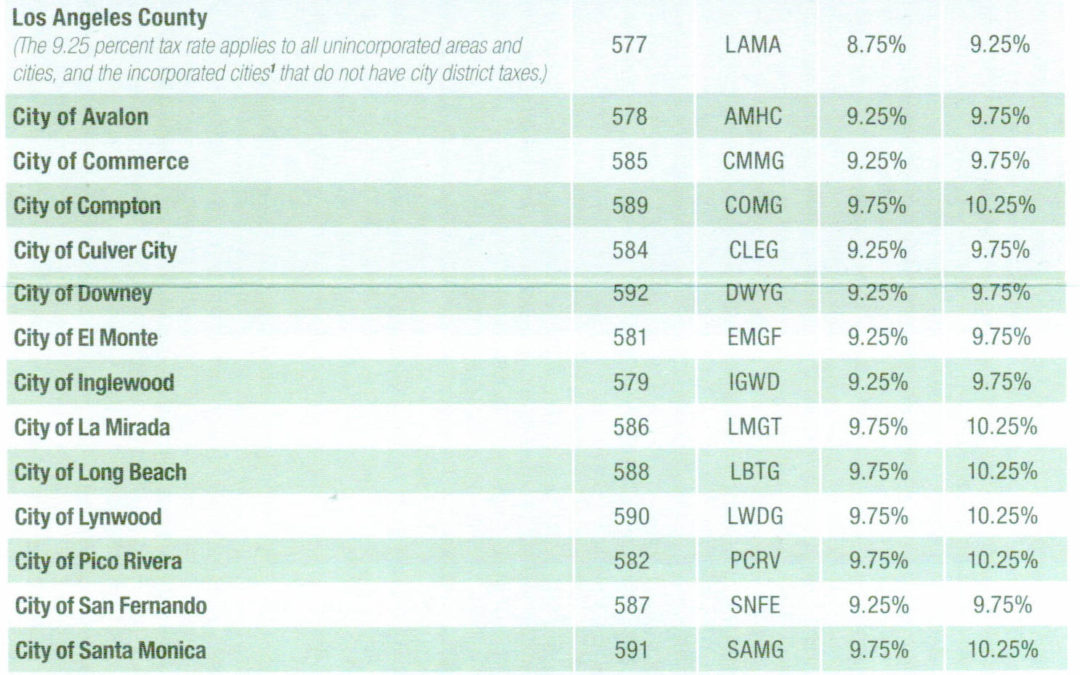

Unless a city has passed addition legislation for a higher tax rate, the new percentage will be 9.25%, up from 8.75%. The following cities will have a higher rate:

| Avalon | 9.75% |

| City of Commerce | 9.75% |

| Compton | 10.25% |

| Culver City | 9.75% |

| Downey | 9.75% |

| El Monte | 9.75% |

| Inglewood | 9.75% |

| La Mirada | 10.25% |

| Long Beach | 10.25% |

| Lynwood | 10.25% |

| Pico Rivera | 10.25% |

| San Fernando | 9.75% |

| Santa Monica | 10.25% |

| South El Monte | 9.75% |

| South Gate | 10.25% |

As a retailer, if you charge the incorrect tax rate, you are responsible for paying the difference. The proper rate will be calculated on the sales tax return when the information is filed.

The tax rate is determined where the customer receives the merchandise, not where your business is located.

A sale is considered to have occurred when the client receives the merchandise unless the contract specifically says title to the items transfers prior to delivery.

If you want to check the rate of a specific county or city, the BOE has locations listed alphabetically by both city and county and rates can be verified online at any time. The new rates will be listed after July 1. To find a sales tax rate by address, see https://maps.gis.ca.gov/boe/TaxRates/. To see rates by city or county, you can go to http://www.boe.ca.gov/sutax/pam71.htm and find the link to view rates online once the website has been updated (the new rates must take effect prior to the website changing the information). You can, however, find an excel worksheet with all of the rates as of July 1 on this page now.

It is a good idea to check the BOE website prior to the start of a new quarter to see what rates (if any) have changed.

Thanks the information clarify online purchase application of destination. I inform businesses the tax is low or incorrect they indicate it represents where the business or shipping from of the product not my State California.

Hi Margaret,

In the past, the rule had generally been that if you are shipping out of state that sales tax does not have to be collected. However, with the passage of the Wayfair vs. South Dakota ruling, states can now require vendors to collect sales tax for items shipped into their location even if no physical presence exists. States are currently determining the threshold for amounts sold to trigger sales tax collection. I have shared multiple blogs since the passage of the ruling to educate business owners on this topic. Please see the following:

https://affordablebookkeepingandpayroll.com/supreme-court-ruling-change-law/

https://affordablebookkeepingandpayroll.com/retailers-expect-supreme-court-ruling/

https://affordablebookkeepingandpayroll.com/california-instates-new-sales-tax-law/

https://affordablebookkeepingandpayroll.com/new-amnesty-laws-wake-wayfair-v-south-dakota/

The main thing to keep in mind is that we must follow the laws of the state where merchandise is shipped. It’s imperative to keep up on changes as they occur when requirements are determined for out of state sellers shipping merchandise into their states.