by Candy | Feb 27, 2024 | Business, Featured

This blog emphasizes the crucial role of a registered agent when forming a limited liability company (LLC) or a corporation for a small business. It outlines the responsibilities of a registered agent, including receiving legal documents, government correspondence,...

by Candy | Feb 26, 2024 | Business, Community

In the contemporary business landscape, online interactions have become the norm, necessitating a clear understanding of the distinct roles of Privacy Policies and Terms & Conditions. These two key documents are crucial for legal compliance and fostering positive...

by Candy | Feb 23, 2024 | Video Blogs

Misinformation or outdated advice about online security can leave your personal data exposed. The following are five common browser security myths that need to be debunked to ensure an accurate understanding of browser security and the browser itself. Misconception 1:...

by Candy | Feb 19, 2024 | Taxes

The “convenience of the employer” rule for taxing income in a specific state is causing trouble for people who live in one state but work in another. Most states tax income based on where the work is done. For example, if you work in Colorado, you pay...

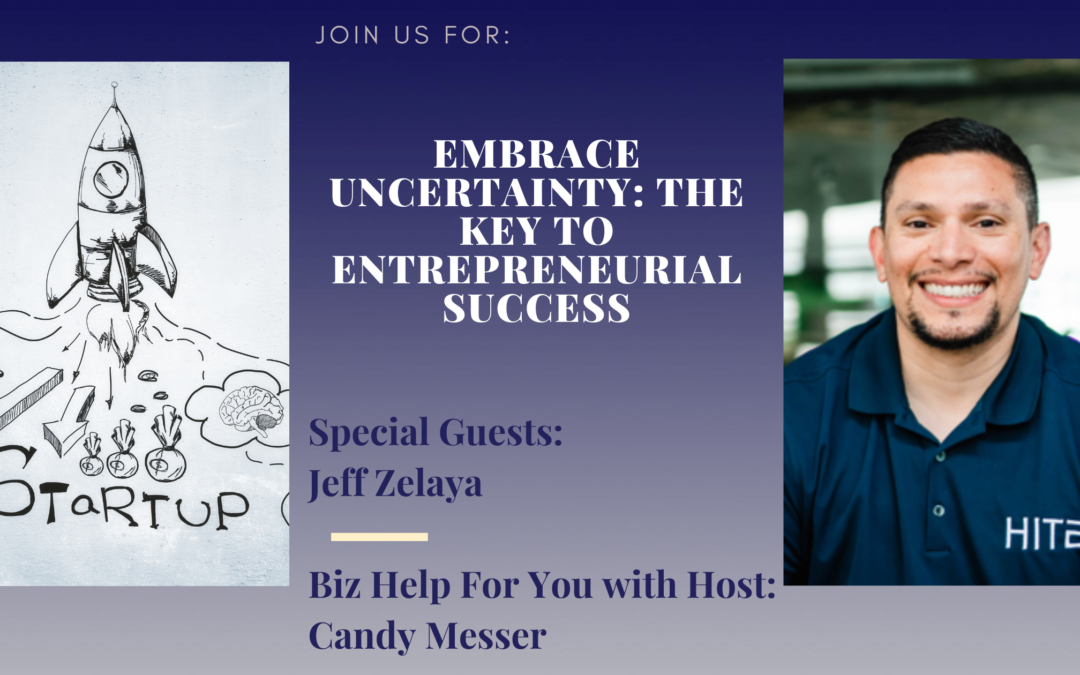

by Candy | Feb 16, 2024 | Podcast

Curious about how embracing uncertainty can give businesses a competitive edge? Join me in this episode of Biz Help For You where I chat with Jeff Zelaya, an experienced entrepreneur and marketing consultant. Jeff’s insights are a game-changer for small business...