by Candy | Dec 9, 2020 | Business, Featured, Payroll, Taxes

If you are a small business owner, one of the financial requirements you are responsible for undertaking on behalf of your company is the collection and payment of payroll taxes. Payroll taxes, which are a percentage of wages held from employees’ paychecks and paid to...

by Candy | Sep 28, 2020 | Bookkeeping, Business, Payroll

Are you a California employer that does not have an employee retirement plan in place? If so, tune in as this information is important to you. The state of California requires that all employers allow their employees to save for retirement. And if a plan is not in...

by Candy | Sep 24, 2020 | Bookkeeping, Business, Payroll, Sales Tax, Taxes

What Deferral Means Are you an employee wondering if you should ask your employer about having your payroll taxes deferred through the end of the year, or are you an employer wondering if you should offer this to your employees? Listen in to hear more about this! If...

by Candy | Sep 11, 2020 | Payroll

Are you an employer who wonders if you should offer the payroll tax holiday to your employees, or are you curious about how that tax would be repaid? The law states that payroll taxes can be deferred from September through December 2020. And recently, the IRS has...

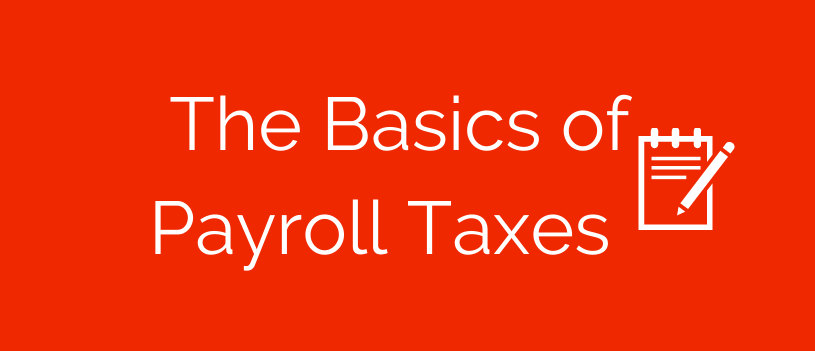

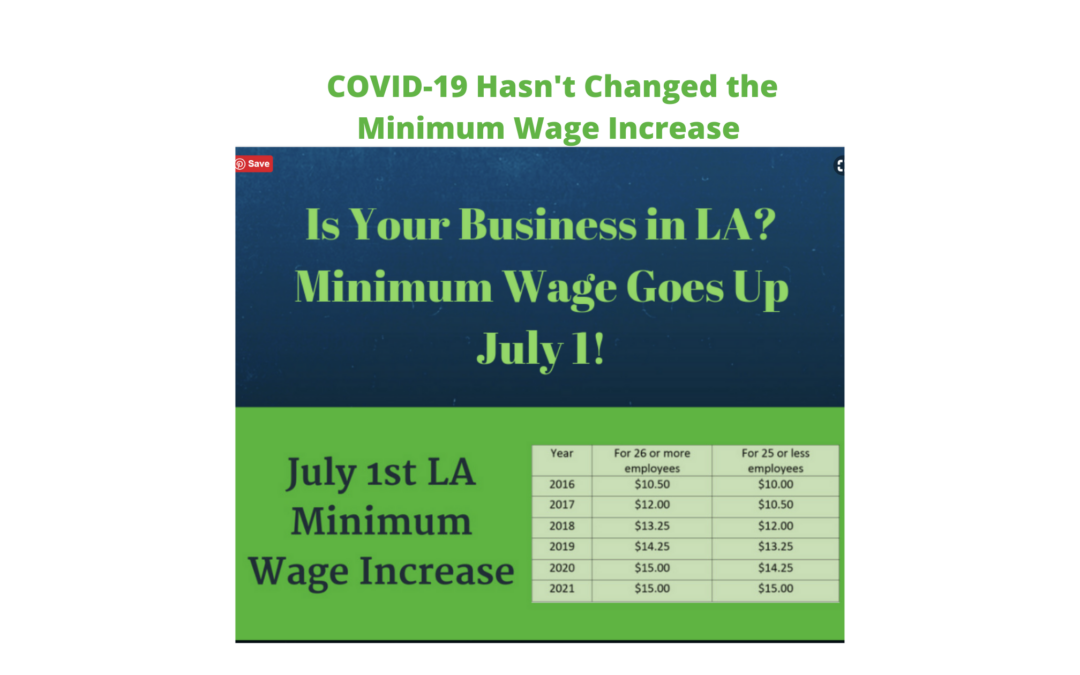

by Candy | Jun 25, 2020 | Payroll

Although COVID-19 is wreaking havoc on the economy, previously passed legislation raising the minimum wage is set to take effect again. If you are operating in the city of Los Angeles or unincorporated areas of Los Angeles County, be prepared to raise wages as of July...

by Candy | Jun 2, 2020 | Payroll

President Donald Trump has called for a payroll tax cut in response to the COVID-19 crisis, saying “I like the idea of payroll tax cuts. I’ve liked that from the beginning. A lot of economists would agree with me. A lot of people agree with me,” at a press conference...